In this blog we’ve never shared the widespread notion that the rise of Argentine inflation in the last couple of years reflected a growth of demand in excess of supply. (Lacienciamaldita thinks, rather, that it’s the dollar, stupid). We have several problems with the “demand and supply” explanations of inflation. To be sure, we don’t quite understand what is meant by “supply” in the macroeconomic debate. And not even sure about demand: we are unable to draw a Keynesian aggregate demand schedule in classroom without feeling dishonest. Is there are positive relationship between the global availability of goods and the general price level? Is there a downward sloping curve relating prices and spending? We’re not convinced. Demand and supply are great for micro, but probably confusing for macro.

Another explanation of the reemergence of inflation along the lines of supply and demand identifies supply with production and demand not with aggregate demand (which always equals production) but with absorption, ie., public and private spending in consumption and investment. If spending was in fact growing faster than production, then the gap between them (net exports) should be increasing. Why, then, should we expect inflation? While net exports can adjust for the difference between spending and production in tradable sectors, that void cannot be filled from abroad in non-tradable goods (and, particularly, services). Prices rise to eliminate the gap between spending and production. Again, when inflation began its current rise Argentine macroeconomic data was hard to square with this explanation. If net exports are indeed a measure of the pressure of domestic spending on production, then the comfortable trade surplus, at around 3% of GDP in 2005, was suggesting that spending wasn’t to be blamed.

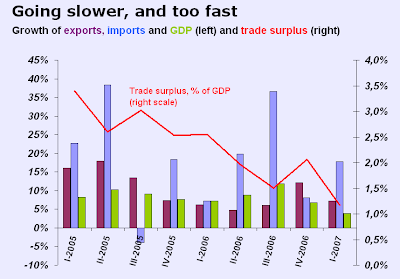

Alas, the picture has been changing lately:

This I do call heating. After the astonishing post-crisis recovery, the rate of import growth had been converging gradually to that of GDP growth. But since a while ago imports decoupled again from GDP, and are rising at 20%, compared to 8% (and falling) of GDP, and 10% of exports. The trade surplus is falling, so the temperature is rising. Maybe we’re not yet overheating (a surplus is a surplus is a surplus) but welcome, at least, to preheating.

No hay comentarios:

Publicar un comentario